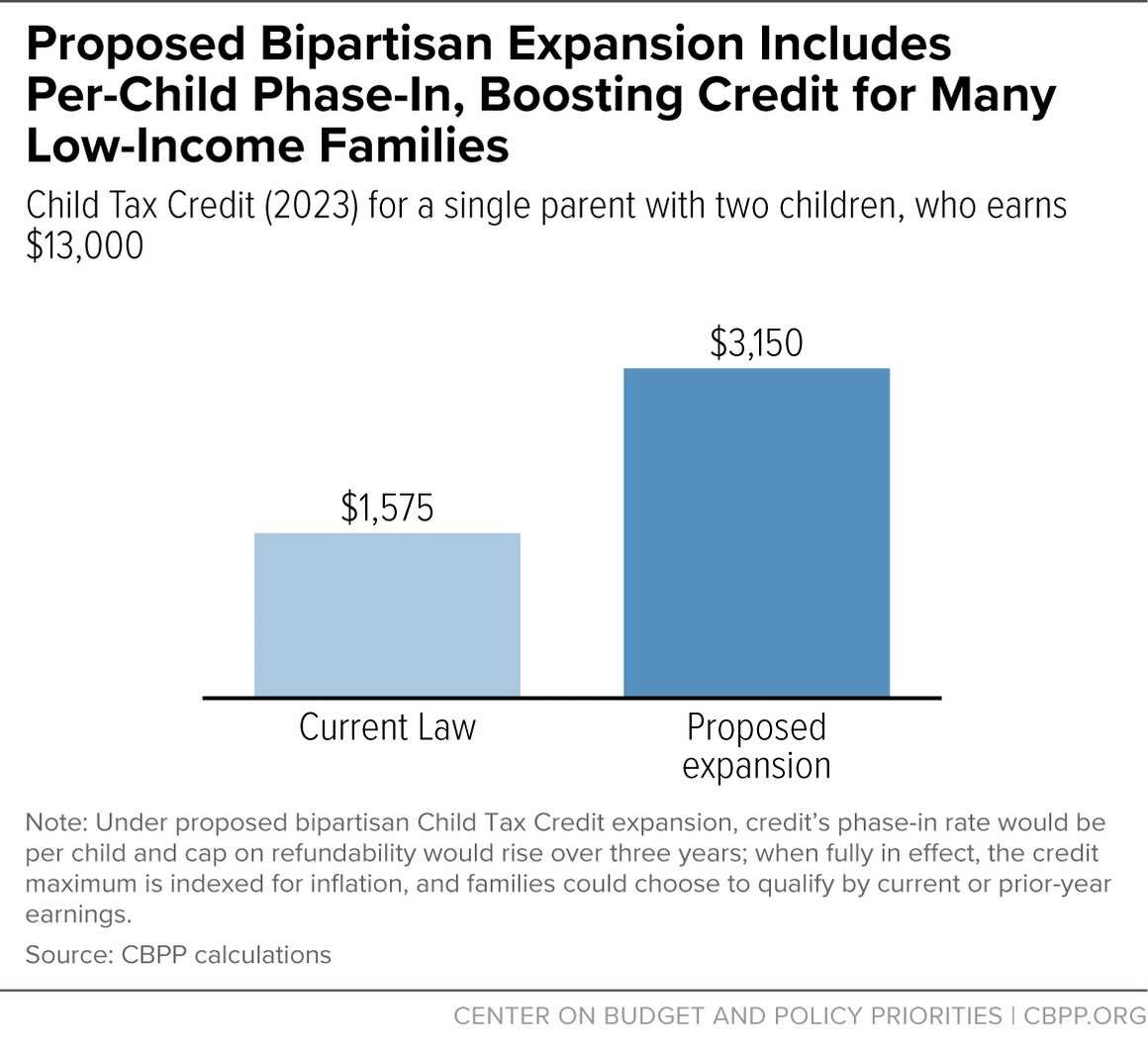

About 16 Million Children in Low-Income Families Would Gain in First Year of Bipartisan Child Tax Credit Expansion

$ 12.00 · 4.9 (399) · In stock

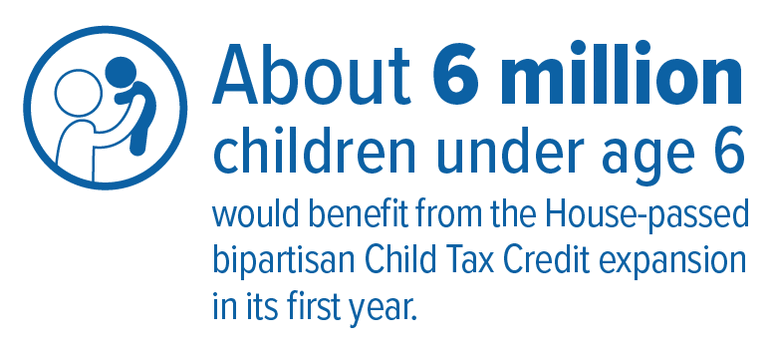

Half a million or more children would be lifted above the poverty line when the proposal is fully in effect in 2025.

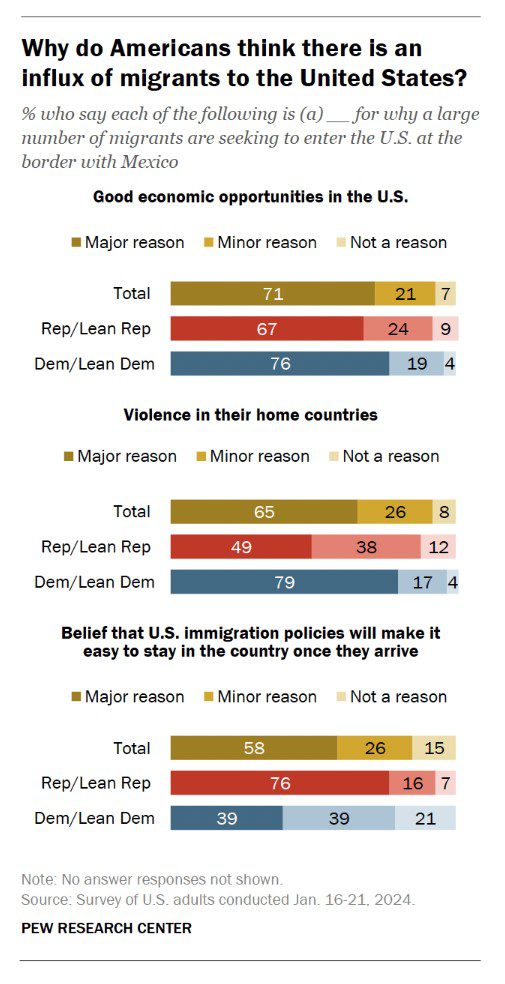

Child tax credit could increase under new bipartisan tax proposal

Changes in Child Tax Credit Would Have Outsized Impact on Rural Children

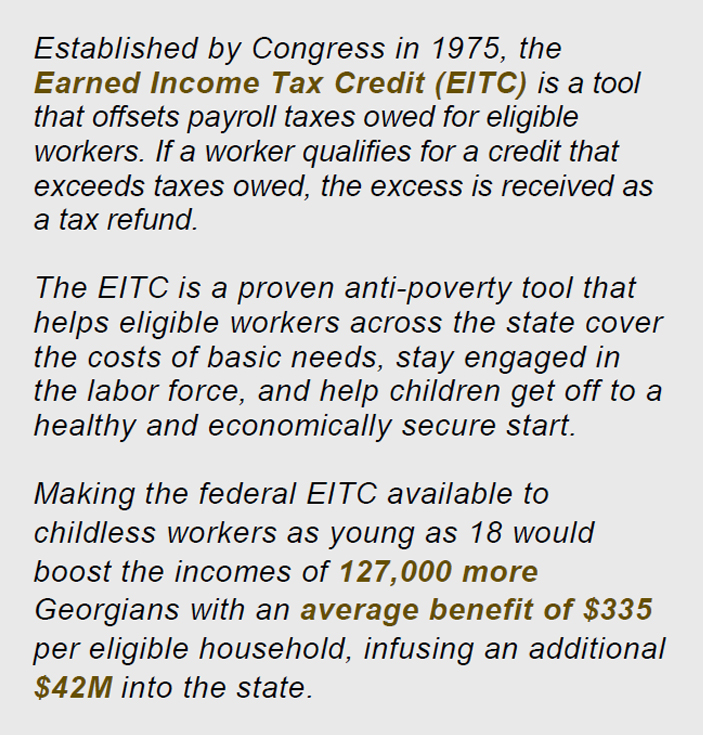

The Earned Income Tax Credit and Young Adult Workers - Georgia Budget and Policy Institute

Stimulus Payments, Child Tax Credit Expansion Were Critical Parts

Chelsea Wilkinson (@hellseathinks) / X

Congress announces deal to expand the Child Tax Credit. Here's what to know – NBC4 Washington

Parents Policy Commons

the Early Childhood Partnership of Adams County on LinkedIn: Gary

Cash at the State Level: Guaranteed Income Through the Child Tax Credit - Jain Family Institute

Congress Rushes to Avert a Shutdown as Conservatives Fume

Infographics Archives - information for practice

Child tax credit could increase under new bipartisan tax proposal

Bipartisan Child Tax Credit Expansion Would Benefit About 6 Million Young Children